Offshore Trust Structures Explained: Everything You Need to Know

Offshore Trust Structures Explained: Everything You Need to Know

Blog Article

Comprehending the Perks of Developing an Offshore Trust for Asset Security

Developing an offshore trust has actually ended up being a tactical choice for people looking for asset defense. Such counts on provide an organized means to safeguard wealth versus legal claims and creditors. With territories like the Cook Islands and Nevis providing strong legal structures, lots of wonder regarding the full spectrum of advantages. This elevates essential questions about personal privacy, tax ramifications, and exactly how these trusts can assist in reliable estate planning. What advantages might this technique hold for one's economic future?

What Is an Offshore Depend on?

Boosted Possession Protection

Enhanced asset defense with overseas depends on supplies substantial benefits in lawful territory, permitting individuals to protect their wide range from prospective cases (Offshore Trust). Additionally, the focus on personal privacy and discretion warranties that sensitive economic information stays protected. By employing threat diversity strategies, people can successfully minimize potential dangers to their possessions

Lawful Territory Benefits

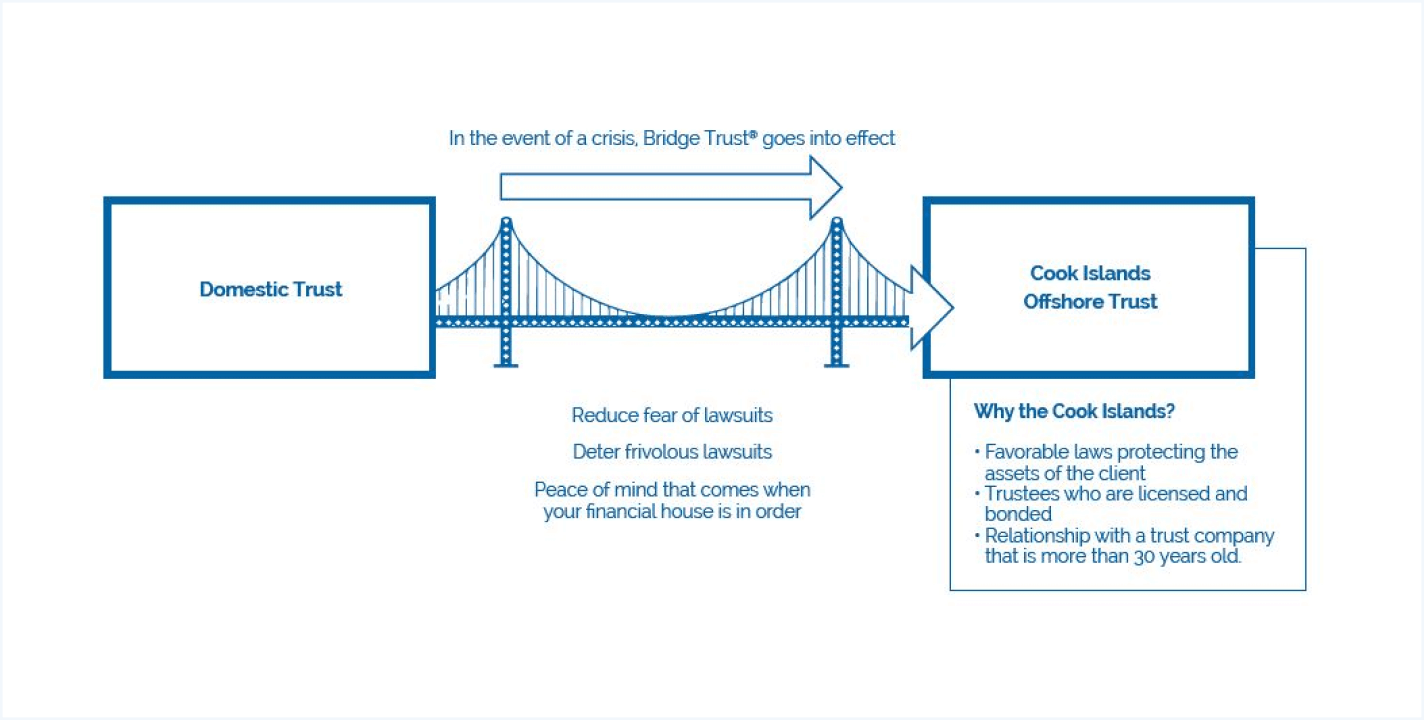

When considering possession security techniques, the legal territory of an offshore count on plays an important duty in securing riches from potential cases and creditors. Different jurisdictions offer distinctive advantages, consisting of positive laws that can restrict financial institution accessibility to trust fund assets. Countries such as the Cook Islands and Nevis are understood for their robust asset security laws, which can provide substantial barriers versus legal challenges. Furthermore, some territories enforce stringent needs for starting litigation versus depends on, even more improving protection. The ability to select a territory with strong lawful structures enables people to tailor their property protection approaches effectively. Eventually, picking the best lawful environment can bolster the effectiveness of an overseas count on protecting wide range versus unforeseen financial dangers.

Privacy and Privacy

Among the pivotal attributes of offshore trusts is their ability to supply personal privacy and confidentiality, which considerably adds to property defense. By establishing an offshore count on, people can shield their properties from public analysis, legal insurance claims, and potential creditors. The depend on structure permits the separation of possession and control, making it challenging for 3rd parties to ascertain real valuable proprietors of the assets held within. Furthermore, lots of overseas territories use stringent confidentiality laws that shield the identity of recipients and trustees. Offshore Trust. This degree of privacy not just deters undesirable focus but also safeguards sensitive economic details. Consequently, the boosted privacy provided by overseas counts on serves as a robust method for people intending to shield their wide range from possible threats

Danger Diversity Approaches

Exactly how can individuals properly safeguard their wealth against unexpected hazards? Risk diversification strategies play an essential role in improved asset protection. By dispersing assets across different financial investment lorries-- such as real estate, stocks, and bonds-- individuals can minimize the impact of market volatility or legal effects. Offshore depends on additionally match these techniques by supplying a secure lawful structure that separates assets from personal liabilities. This splitting up not only shields assets from financial institutions yet also enables better administration of danger direct exposure. In addition, consisting of foreign financial investments within an overseas count on can use defense versus residential financial recessions. On the whole, using a varied approach, combined with the benefits of offshore trusts, greatly fortifies one's monetary strength versus potential risks.

Privacy and Privacy Advantages

Offshore depends on provide considerable benefits relating to personal privacy and confidentiality. These structures provide boosted privacy actions that protect the identifications of beneficiaries and maintain the secrecy of property holdings. Therefore, individuals seeking to guard their riches can take advantage of a higher degree of discernment in their financial affairs.

Improved Personal Privacy Steps

What benefits do improved privacy actions provide when it pertains to asset security via trust funds? Offshore trusts provide a substantial layer of personal privacy that safeguards the identification of the grantor and beneficiaries. By making use of jurisdictions with rigorous discretion laws, individuals can protect their economic affairs from public examination and prospective lawsuits. Boosted privacy procedures decrease the threat of asset exposure, as details regarding the trust fund's presence and its assets are often not openly available. In addition, overseas counts on can leverage anonymity with using company entities, even more additional info obscuring possession. This level of discernment not just deters potential financial institutions yet likewise ensures that individual financial matters stay personal, allowing people to manage their wide range without excessive disturbance or issue.

Discretion of Recipients

Enhanced privacy actions not just secure the grantor yet additionally expand considerable discretion advantages to beneficiaries of overseas depends on. By establishing an overseas trust fund, beneficiaries can preserve a level of privacy regarding their monetary rate of interests. This privacy guards them from public analysis and possible lawful obstacles, as the details of count on possessions and beneficiaries are not disclosed in public records. Furthermore, the jurisdiction in which the trust fund is developed commonly has rigorous personal privacy laws that further protect beneficiary identities. This degree of secrecy can be important in high-stakes atmospheres, enabling recipients to handle their inheritances without exterior stress or risks. Inevitably, the discretion provided by overseas trust funds fosters a safe and secure setting for beneficiaries to take advantage of their possessions without excessive direct exposure.

Secrecy in Possession Holdings

While individuals typically seek privacy for various reasons, the usage of overseas trusts gives a substantial layer of secrecy in property holdings. Offshore trusts make it possible for possession owners to protect their wide range from public examination and potential legal claims. By placing properties in a trust fund, people can cover their ownership, making it testing for plaintiffs or lenders to map or access these holdings. In addition, lots of offshore territories have stringent privacy legislations that better secure the identifications of trustees and beneficiaries. This anonymity aids protect against undesirable interest and financial dangers. Consequently, the discretion afforded by overseas depends on not only enhances personal safety and security yet also advertises comfort for possession owners, allowing them to handle their wealth with discretion.

Prospective Tax Obligation Advantages

Overseas trust funds are mainly developed for asset security, they can likewise offer considerable tax obligation benefits that attract lots of individuals. One crucial benefit is the capacity for tax deferment, permitting assets to expand without prompt taxation. This can be especially helpful for high-net-worth individuals seeking to maximize their investments over time.Additionally, particular territories offer beneficial tax treatment for overseas counts on, including minimal or absolutely no funding gains tax obligation, estate tax, or inheritance tax. By putting possessions in an offshore count on, people may lower their overall tax responsibility, depending on their home country's regulations.Furthermore, overseas counts on can help with tax-efficient circulations to beneficiaries, potentially lowering the taxable income they would certainly or else face. It is critical for individuals to seek advice from with tax obligation professionals to browse complex global tax laws and guarantee compliance while maximizing these prospective advantages. The tax benefits of offshore counts on can be engaging for those seeking financial optimization.

Estate Preparation and Riches Transfer

Estate planning and wide range transfer are essential considerations for individuals seeking to safeguard their monetary tradition and assure their possessions are dispersed according to their wishes. Offshore trusts can play a substantial function in this procedure, providing a structured way to manage and safeguard assets while ensuring they are handed down to recipients efficiently.By placing assets in an offshore depend on, individuals can establish clear standards for distribution, assisting to decrease prospective disputes among heirs. In addition, offshore counts on can promote smoother changes of wealth throughout generations, enabling for calculated planning that takes into consideration prospective tax ramifications and legal requirements in numerous jurisdictions.Such depends on can additionally provide personal privacy, securing monetary info from public analysis throughout the estate negotiation procedure. Inevitably, including an overseas trust fund right into estate preparation can enhance the security of assets and Check This Out offer comfort for people worried regarding their financial heritage.

Versatility and Control Over Possessions

Offshore trust funds not just boost estate planning and riches transfer but additionally supply substantial versatility and control over possessions. By developing such a trust fund, people can dictate the terms under which their possessions are taken care of and distributed, customizing setups to meet specific demands. This versatility permits the addition of various property courses, such as genuine estate, investments, and service rate of interests, securing them from possible creditors or legal challenges.Furthermore, the trust framework permits modifications to beneficiaries and distribution terms as individual conditions evolve, making sure that the count on remains appropriate throughout the grantor's life time. The trustee, frequently chosen by the grantor, offers an added layer of control, enabling specialist management of possessions while adhering to the grantor's wishes. This mix of customized plans, versatility, and professional oversight makes overseas depends on an enticing choice for those seeking to keep control over their wide range while shielding it from outside risks.

Picking the Right Territory for Your Trust fund

How does one figure out the very best jurisdiction for an overseas count on? The selection procedure includes reviewing numerous essential factors. Initially, the legal structure of the territory must offer robust possession security regulations, guaranteeing that the count on is protected from creditors and legal insurance claims. Second, the jurisdiction's tax obligation implications are important; an optimal location needs to provide beneficial tax obligation therapies without extreme burdens.Additionally, the political and financial stability of the jurisdiction is extremely important, as uncertainties can affect the trust fund's safety and security. Access and the track record of regional banks also play a considerable function, as reputable experts are vital for managing the depend on effectively.Finally, conformity with international guidelines, such as the Usual Reporting Requirement (CRS), should be taken into consideration to avoid prospective legal difficulties. By carefully examining these aspects, people can pick a territory that ideal aligns with their possession protection goals.

Frequently Asked Inquiries

What Are the Preliminary Prices of Establishing an Offshore Trust?

The preliminary costs of establishing up an offshore count on can differ substantially, typically ranging from a few thousand to 10s of countless bucks. Factors affecting these prices include jurisdiction, legal charges, and trustee option.

Just How Do Offshore Trusts Influence My Present Estate Planning?

Offshore depends on can considerably affect estate preparation by giving asset security, tax obligation benefits, and boosted personal privacy. They might likewise make complex the circulation process and demand cautious consideration of legal and tax obligation implications for recipients.

Can an Offshore Trust Protect Versus Legal Actions?

An offshore depend on can potentially supply protection against suits by positioning assets past the reach of financial institutions. The performance varies based on territory and the particular scenarios bordering each legal insurance claim or dispute.

Are Offshore Trusts Legal in My Nation?

Figuring out the legality of overseas trusts varies by jurisdiction. Individuals ought to speak with lawful specialists in their certain nation to recognize neighborhood legislations and laws governing the facility and operation of such monetary tools.

How Do I Manage My Offshore Trust Fund Remotely?

Managing an offshore count on from another location includes utilizing protected on the internet systems, keeping routine communication with trustees, and making sure conformity with legal requirements. Normal tracking of investments and prompt documents submission are important for effective monitoring and oversight. An offshore trust is a legal setup that permits people to position their possessions in a depend on entity located outside their home country. The trust fund is carried out by a trustee, that holds and manages the assets according to the problems establish forth by the trustor, the person that produces the trust - Offshore Trust.Offshore trust funds can hold various kinds of possessions, including actual estate, financial investments, and cash. By putting assets in an overseas trust, people may reduce their total tax obligation obligation, depending on their home country's regulations.Furthermore, overseas depends on can facilitate tax-efficient circulations to beneficiaries, potentially decreasing the taxed income they would certainly otherwise encounter. Offshore counts on can play a substantial duty in this process, providing an organized method to handle and secure properties while guaranteeing they are view it now passed on to recipients efficiently.By putting assets in an overseas depend on, individuals can establish clear standards for distribution, aiding to lessen possible disputes among heirs. Furthermore, overseas trusts can facilitate smoother adjustments of wealth throughout generations, enabling for calculated planning that takes right into account possible tax obligation ramifications and lawful requirements in various jurisdictions.Such depends on can likewise offer personal privacy, shielding monetary info from public analysis during the estate settlement procedure

Report this page